Description

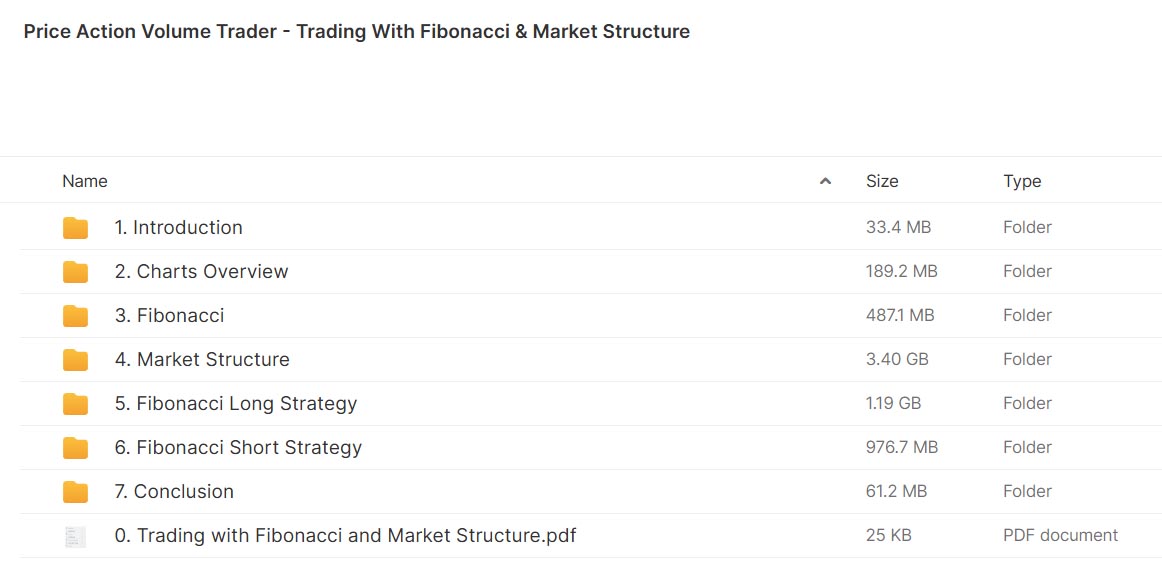

Price Action Volume Trader – Trading With Fibonacci & Market Structure [DOWNLOAD PROOF]

![]()

Price Action Volume Trader – Trading with Fibonacci & Market Structure is a trading strategy that combines technical analysis methods, primarily price action, volume analysis, and Fibonacci retracements, with a strong focus on understanding market structure. This approach aims to help traders identify high-probability trade setups by studying how price moves, how much volume is traded, and how key Fibonacci levels and market structure patterns align.

Key Components of the Strategy:

- Price Action:

- Price action trading is all about reading the market’s behavior through the actual price movement on the chart, without relying on lagging indicators.

- Traders look for specific candlestick patterns, chart formations, and trends to gauge potential price movement.

- The emphasis is on interpreting raw price data and using it to make decisions, rather than relying on technical indicators like moving averages or oscillators.

- Volume Analysis:

- Volume is the lifeblood of the market, and analyzing volume alongside price action can provide valuable insights into the strength or weakness of a price movement.

- Volume spikes often accompany major price movements, signaling a possible continuation or reversal.

- Volume can help confirm the validity of price action signals, such as breakouts, trend reversals, or continuation patterns.

- Fibonacci Retracements:

- Fibonacci levels are a popular tool for identifying potential support and resistance zones in the market.

- After a strong price movement, traders use Fibonacci retracement levels (typically 23.6%, 38.2%, 50%, 61.8%, and 78.6%) to anticipate where the price might pull back before continuing in the direction of the trend.

- These levels are often seen as areas where price could either stall or reverse, depending on how the market reacts to them.

- Market Structure:

- Market structure refers to the overall trend and key price levels that define the current market conditions. This includes identifying swing highs, swing lows, support, and resistance zones.

- Traders often look for patterns like higher highs and higher lows in an uptrend or lower highs and lower lows in a downtrend.

- Understanding market structure is crucial for determining whether the market is in a trend or range-bound, which helps in deciding the most appropriate strategy to apply.

How the Strategy Works:

- Trend Identification:

- Traders start by identifying the current trend (uptrend or downtrend) using market structure analysis. This sets the context for where to look for trade setups.

- In an uptrend, the focus is on buying opportunities, while in a downtrend, the focus shifts to selling opportunities.

- Key Fibonacci Levels:

- Once the trend is identified, Fibonacci retracement levels are plotted on the most recent significant price swing. These levels are used to anticipate potential price pullbacks.

- Traders watch for price to pull back to one of these levels (often the 38.2%, 50%, or 61.8% level) and look for price action signals like reversal candlestick patterns or other price action setups to enter trades.

- Volume Confirmation:

- Volume analysis is used to confirm price action signals. For example, a breakout above a resistance level with high volume is a strong confirmation of a valid breakout.

- If price pulls back to a Fibonacci level with low volume and then begins to move higher, this suggests that there is not much selling pressure, and the uptrend might continue.

- Entry and Exit Points:

- Entry: A trade entry is triggered when price reaches a key Fibonacci level and shows a valid price action pattern, such as a bullish engulfing candle, pin bar, or inside bar at the retracement level, confirmed by volume.

- Exit: The exit point can be determined using other Fibonacci levels or key market structure levels (such as previous swing highs or lows). Additionally, traders can use trailing stops to ride a trend for as long as possible while protecting profits.

- Risk Management:

- Proper risk management is crucial, as no trading strategy is foolproof. Traders typically use stop-loss orders to protect against large losses if the trade goes against them.

- A common technique is to place the stop-loss just beyond the next key level of support or resistance or outside of the Fibonacci retracement zone.

Advantages of the Strategy:

- Simplicity: This strategy doesn’t rely on complicated indicators but focuses on key market factors like price movement, volume, and Fibonacci levels.

- High Probability Setups: By combining price action and volume analysis, traders increase their chances of identifying high-probability trade opportunities.

- Adaptability: It works across various timeframes, from intraday trading to longer-term investing.

Disadvantages of the Strategy:

- Requires Skill and Experience: While the strategy is powerful, it requires practice and experience to interpret price action and volume correctly.

- False Signals: In volatile or choppy markets, price action can be misleading, and Fibonacci levels may not always hold.

Overall, the Price Action Volume Trader – Trading with Fibonacci & Market Structure strategy provides traders with a disciplined and methodical approach to trading. It helps in recognizing strong price levels, confirming with volume, and using Fibonacci retracements to anticipate future price action, offering a clear path to profitable trading.

Price Action Volume Trader – Trading With Fibonacci & Market Structure

Trading With Fibonacci & Market Structure course by Price Action Volume Trader buy,

Trading With Fibonacci & Market Structure by Price Action Volume Trader buy,

Trading With Fibonacci & Market Structure course by Price Action Volume Trader buy,

Trading With Fibonacci & Market Structure by Price Action Volume Trader Course buy,

Trading With Fibonacci & Market Structure by Price Action Volume Trader Course buy online,

Buy Trading With Fibonacci & Market Structure by Price Action Volume Trader,

Price Action Volume Trader – Trading With Fibonacci & Market Structure download,

Buy Trading With Fibonacci & Market Structure by Price Action Volume Trader Course,

Trading With Fibonacci & Market Structure by Price Action Volume Trader cheap price,

Trading With Fibonacci & Market Structure – Price Action Volume Trader buy,

Trading With Fibonacci & Market Structure by Price Action Volume Trader Download,

Trading With Fibonacci & Market Structure – Price Action Volume Trader Course buy,

Trading With Fibonacci & Market Structure – Price Action Volume Trader Course buy online,

Buy Trading With Fibonacci & Market Structure – Price Action Volume Trader,

Buy Trading With Fibonacci & Market Structure – Price Action Volume Trader Course,

Trading With Fibonacci & Market Structure – Price Action Volume Trader buy cheap price,

Price Action Volume Trader – Trading With Fibonacci & Market Structure course download,

Price Action Volume Trader – Trading With Fibonacci & Market Structure download,

Trading With Fibonacci & Market Structure by Price Action Volume Trader course download,

Trading With Fibonacci & Market Structure by Price Action Volume Trader download,